11990 Grant St., Suite 550 Northglenn, CO 80233

Considering a downsize? Here’s what to keep in mind.

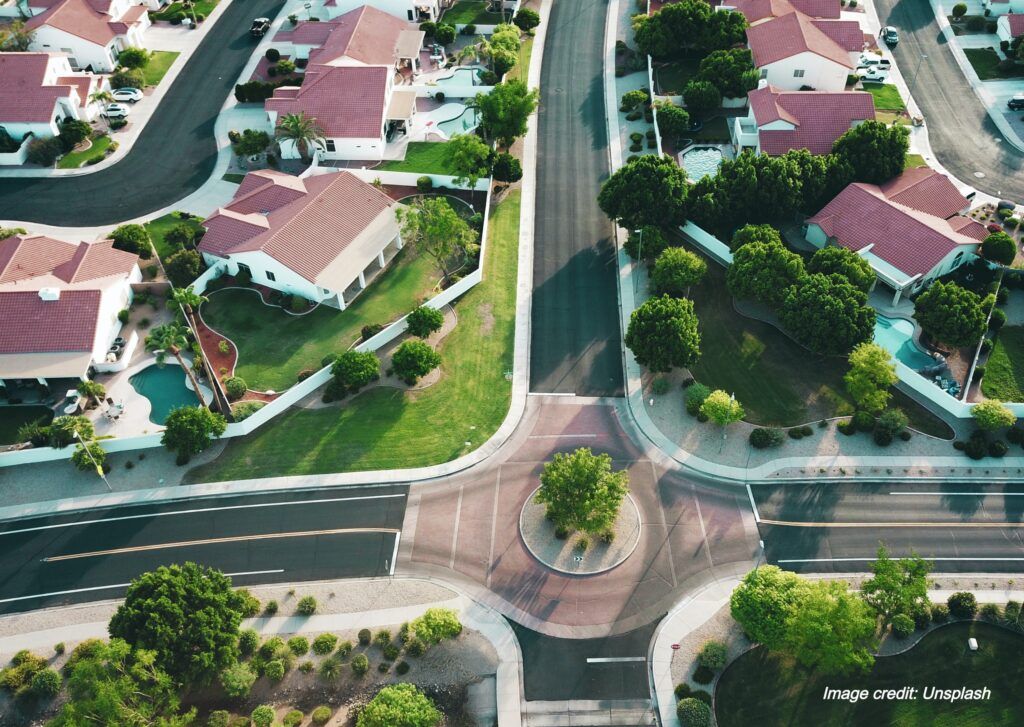

Life is a series of decisions, momentous or otherwise. The myriad choices you need to make as you embark on your golden years definitely fit the former, one of which is the decision to downsize which comes with plenty of benefits. It’s been known to improve the quality of life for many seniors by decreasing their responsibilities, which, in turn, lessens stress, as well as allows for more room to accommodate newfound mobility requirements.

However, with downsizing comes another big choice to make — that is, what you should do with the place you’ve called home through the years. You worked hard to make this home a reality, and you have the memories to show for it. As such, determining its future is definitely a decision that’s not to be taken lightly. Here are your options.

Let It Go: For most retirees and empty-nesters, living in a too-large home is just too much work, responsibility, and expense. This makes downsizing a smart decision. In fact, selling your home is one of the most sensible things you can do at this juncture.

It’s been recently reported that a good 43 percent of home sellers are seniors aged between 54 and 72 years old. This is an indicator of how seniors are taking advantage of their real estate investments and using the proceeds to move to smaller, more accessible homes or even funding their stay in assisted living facilities.

That said, it’s not as simple as it sounds. There are numerous challenges to downsizing, and not the least of it is finding out that your home is worth less than anticipated. In today’s volatile housing market, there’s a big chance that this could be the case.

Currently, the median price of a home in the Denver area is around $432,000, but of course, this varies by neighborhood. It is crucial, therefore, to get to know the real estate climate in your city and state before making any big decisions. You can then determine if it’s worth putting your property on the market or exploring other options.

Let It Be Your Lasting Legacy

When it comes to your family home, it’s more than natural to want to keep it in the family. Not only are old memories preserved, but new ones will also be made by the next generation, making this a truly inviting prospect.

However, what most people don’t realize is it’s not a simple matter of handing over the keys to the children and wishing them well. As a matter of fact, you could end up giving your heirs a barrage of unwelcome expenses, as gifting your home comes with a plethora of tax consequences. Even more pressing is how this could affect your Medicare eligibility which you need for your long-term care. It goes without saying that as tempting as it would be to err on the side of sentiment, it’s still more prudent to do your due diligence and explore other avenues, such as “selling” your home to your child for less.

Let It Work for You

Again, you worked hard for most of your life to build a home for your family. It’s high time to turn the tables and make your property work for you. One way to do this is to rent it out

No doubt that a regular rental check is a great supplement to a considerably reduced income post-retirement, along with the tax benefits that come with it. Beyond that, there’s also the likelihood that your property’s value will appreciate while you’re also building equity — both of which translate to more cash flow in the long term.

But of course, this comes with its own set of challenges. Being a landlord can be downright demanding for a senior looking to make the most out of retirement, what with responsibilities such as vetting tenants and staying on top of maintenance, to name a few, as well as keeping up with insurance and tax expenses.

Again, you worked hard for most of your life to build a home for your family. It’s high time to turn the tables and make your property

In a nutshell, downsizing is all about the big picture. With each option as viable as the last, it ultimately boils down to how the pros outweigh the cons — or vice versa — and how they can make possible the life you have in mind.