11990 Grant St., Suite 550 Northglenn, CO 80233

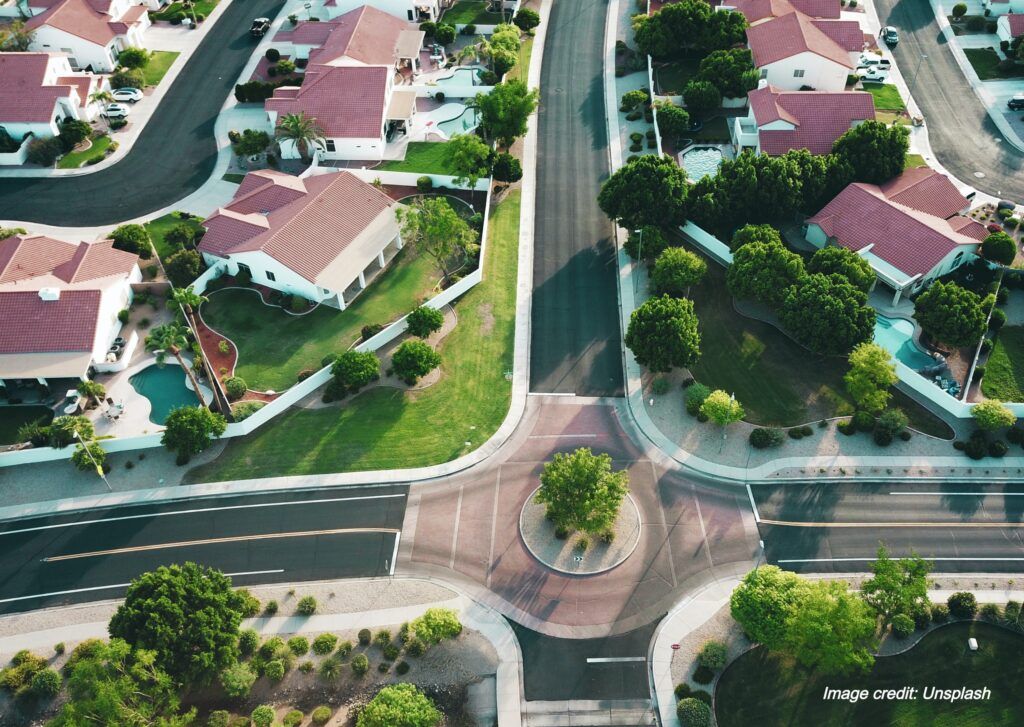

Save More, Save Faster for Your Down Payment

It is always good to plan for big financial milestones. But how do you start? What steps can you take now so you are prepared for an opportunity – like the perfect house – should it appear?

Whether you’re planning to buy a house in a few months or not for a few years, you’re probably thinking about how you’ll save for a down payment or you’re already saving. No matter where you are in the process – or even if you’re already a homeowner and just want to save more – some reminders on how to save money are always appreciated. The biggest thing to remember is that saving takes time and discipline – and it means re-thinking your budget and maybe even earning additional money.

Remember: You may not need to put 20 percent down for your home. In fact, you may only need to put down 5 percent or 3.5 percent. Saving that amount will be a breeze! Your mortgage loan officer can share information with you about loan options and down payment assistance programs.

Get started saving today:

Transfer a fixed amount of money to savings automatically. Set up a savings account that has money automatically transferred into it each month, every two weeks or every week. Every time you get a paycheck, some of that money should be automatically deposited into this account – no questions asked. Your bank can set this up for you, but you have to be disciplined enough to not withdraw from the account!

Bank any extra unexpected income. Get a tax refund? Put it into the savings account. Get a gift of cash? Put it in the savings account. Bonus or large commission? Savings. If this adds up to hundreds or even thousands of extra dollars a year, good for you!

Lower your expenses. Get an antenna and get rid of cable. Stop buying fancy coffees and reduce your trips to restaurants. Lower your data plan on your phone. If you pay your own gas or electric bills, lower your heat in the winter and raise the temperature on your air conditioner in the summer by three degrees in each direction. Wherever you can make a small change, make a small change.

Monitor your online spending. With online shopping at your fingertips and online sellers that generously store your credit card for you, it’s easy to click and spend without even thinking about how much you’re spending or if you really need what you’re buying. Track this spending with an app or keep an old-fashioned spending ledger.

Shop your insurance. If it’s been a while since you checked rates for your car insurance, renter’s insurance, health insurance, look into those costs. You may be able to save hundreds or even thousands of dollars by making a few small changes.

Save your change! Save your pennies, nickels, dimes and quarters. Never spend your change. Get glass jar and start saving. When the jar is full, put the money in your savings account. This will add up fast!

Skip vacations for a year or two. Check out what’s happening in your community, your state and your neighboring states. If you can’t stand the idea of not going away for a year, plan a camping trip and borrow your friends’ equipment. Take the money you would have spent on vacation and add it to your savings account.

Sell things. You’re probably going to purge before you buy your home anyway, so why not sell some things now. That bike you never ride? The extra set of pots and pans you never use? What do you have that has value to someone else? Sell it on Craigslist, Facebook Marketplace, Ebay… wherever there is a buyer for what you want to sell. Put anything you make into your savings account.

Lose the high interest credit card debts. If you’re not paying off your credit cards each month, you’re probably paying a lot in interest. Pay off your credit cards and either stop using them all together or use them minimally. Paying credit card interest will seriously cut into your savings. If you simply cannot pay them off, transfer your balances to a card with the lowest possible interest rate.

Get a second job. Earnings money working a second job can help you save money a lot faster. Even if you’re bartending or waiting tables 10 hours a week, driving for a car service, pet sitting or working in retail, if you take every dime of what you make working a second job and put it into savings, you’ll see your money add up quickly.

Refinance your student loans. Do some research and see if you can get a better interest rate on your student loans. You just might be surprised at what you can save. Whatever money you do save with the lower payment goes into your savings account.

Celebrate your savings successes. Create a savings graph and put it somewhere that you see it. Add to it regularly – at the end of every week. The more you see your savings grow, the faster you’ll get to your down payment. And we think you’ll want to continue making saving something you do regularly.

If you can apply some of the tips listed above you should be well on your way to saving a bit of a nest egg for that big opportunity when it appears. Ready to speak to an experienced Colorado mortgage loan officer? Contact us today!