11990 Grant St., Suite 550 Northglenn, CO 80233

What to Do, and Not Do, When Applying for a Mortgage

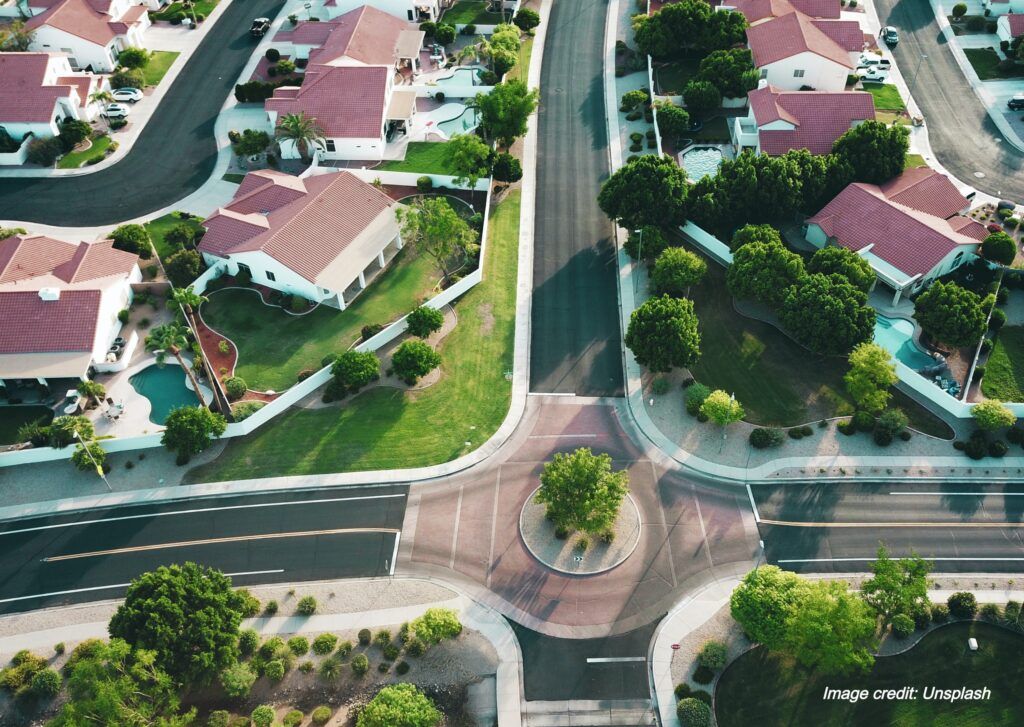

Applying for a mortgage can be a very exciting and stressful time. If you’re not quite sure where begin, you’re not alone. Don’t miss these tips designed to help you avoid unnecessary hurdles as you prepare to purchase your piece of the American Dream.

What to Do

Keep originals and all pages of pay-stubs, bank statements and other important financial documentation. Universal Lending is required to update any documents that are more than 90 days old prior to the closing of your mortgage loan. (This is required even if your loan is approved.)Provide all documentation for the sale of your current home, including sales contract, closing statement, employer relocation/buy-out program if applicable.Notify your Loan Officer if you plan to receive gift funds for closing costs.Notify your Loan Officer of any employment changes such as change of employer, recent raise/promotion, transfer, change of pay status (for example salary to commission).

Make timely payment on all current debt obligations , including any current mortgage or rent, car, student loan, or credit cards.

What Not to Do

Change jobs/employer without inquiring about the impact this change might have on the approval of your loan.Make major purchases during or prior to closing, such as a new car, furniture, appliances, etc., as this may impact your qualification ratios.Obtain and/or deposit unusually large sums of money without notifying your Loan Officer. Many loan guidelines require full documentation as to the source of these funds.Close or open or transfer any asset accounts without asking your Loan Officer about the proper documentation required for your loan file, e.g., transferring retirement funds or funds from the sale of stocks into your checking or savings account.

Open or increase any liabilities, including credit cards, signature loans or other credit lines during the loan process as it may impact your qualifying ratios.

It’s that simple. If you can stick to the do’s and avoid the don’ts we’ve listed here, you’ll be well on your way to securing your home loan.

Ready to speak to an experienced Colorado mortgage loan officer? Contact us today!