11990 Grant St., Suite 550 Northglenn, CO 80233

How to Use Your Amortization Schedule

There are fewer things as rewarding as finally closing on your home loan. We know there are a lot of hoops to jump through, and a lot of paperwork you must provide to us in order to make this happen. In return, what happens at closing? More paperwork! Of course, it’s all very important paperwork regarding your home and loan so it’s necessary but one of the often overlooked pieces of that stack of closing papers is the Amortization Schedule.

The Amortization Schedule is about seven pages long but details exactly how much of your mortgage payment is applied toward principal, interest and PMI if that’s part of your home loan program.

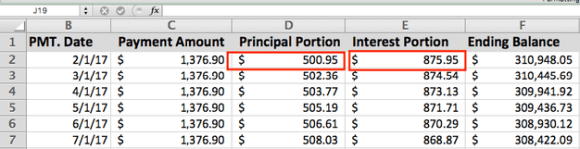

It’s sometimes overlooked that each mortgage payment, while consistent if you have a fixed rate mortgage, is actually the sum of separate values each month. In the example below, there is no PMI (private mortgage insurance) included in this mortgage type so the payment amount is the sum of the principal and the interest.

What you’ll notice is the Principal Portion increases each month while the Interest Portion diminishes each month, shifting the balance of where your monthly payment is applied. Great, so what does this matter to you?

Eliminating Payments Without Paying the Full Payment Amount

You can eliminate payments by paying an additional Principal Portion with your monthly payment. For example, if you were on payment #5, and you wanted to pay additional principal, you would look to the “Principal Portion” on payment line #6, and pay that amount.

Payment Amount: $1,376.90

Additional Principal: $506.61

Total Payment: $1,883.51

By paying the Principal Portion of payment #6, you have eliminated the Interest Portion of payment #6. This does not mean that you don’t make your next regularly scheduled mortgage payment. It simply means that the next payment you make will be payment #7, rather than payment #6.

It is easier to pay additional principal in the earlier years of the loan because this is when the Principal Portion will be the lowest. This makes it a bit more feasible for making additional principal payments should you receive a bonus, or have some extra cash lying around.

The Amortization Schedule and eliminating payments can be confusing. I would be happy to talk with you, and explain it in a bit more detail should you have any questions.

We always appreciate feedback here, so feel free to reach out.